Are import export consulting services really necessary when up to 30% of a shipment’s cost can arise from errors in customs procedures? Many businesses focus only on international shipping costs, inadvertently overlooking legal and compliance risks. This article will clarify these risks and introduce the role of PTN Logistics as your Strategic Logistics Partner.

Discover PTN Logistics’ all-in-one logistics services!

Import export consulting: A comprehensive solution for your cross-border operations

In today’s integrated global economy, importing and exporting are more than just trade transactions; they are a core factor in your business’s success. However, many are unaware of the hidden elements:

- ✅ Hidden risks: Behind the revenue figures lie countless challenges and potential risks—what we at PTN Logistics call the “tip of the iceberg.”

- ✅ Common pain points: Does this process feel overly complicated? Is it unnecessarily time-consuming? Are you dealing with unexpected costs?

Are you searching for a solution to transform “logistics from a cost center” into “logistics as a competitive advantage”? Let’s explore these common challenges together. Discover how an expert import-export consulting service from PTN Logistics can become your “strategic partner.”

This service doesn’t just move your goods; it helps you identify and capitalize on opportunities within your supply chain.

The “Hidden Icebergs”: Common challenges in the import export process

In logistics, especially within import and export, businesses constantly face numerous challenges that go beyond shipping costs or freight rates. In reality, it’s a maze of risks. If not identified and handled professionally, these issues can erode profits and even cause unforeseen damages to your business.

Below are the common difficulties you are likely to encounter. However, an expert import-export consulting service will help you overcome every challenge.

The legal maze & constantly changing policies

These are the hidden yet ever-present risks in import export operations.

The complexity of laws and regulations

The legal systems governing import and export, both in Vietnam and internationally, are incredibly diverse, including laws, circulars, decrees, and official guidelines. Constant changes make it difficult for many businesses to stay updated and compliant. A prime example is the frequent updates to tax policies or regulations for goods requiring special import conditions.

Risks from incorrect HS code classification

One of the greatest risks is applying the wrong Harmonized System (HS) code to goods. This error can lead to incorrect tax rates, administrative fines, and tax recovery actions. Your cargo may be detained and denied clearance because it was misclassified, falls under a prohibited category, or lacks a required specialized permit. This can result in significant financial losses, highlighting the critical role of import-export consulting in providing accurate guidance.

Learn which goods are prohibited for export/import — click here!

Risks from “almost complete” documents that still fall short

In importing and exporting, a single minor error or inconsistency in your documents is enough to get an entire shipment stuck at the port, causing costly delays and fees. A professional import-export consulting service helps you eliminate this risk.

The importance of core documents

A complete and accurate set of customs documents is the key to smooth customs clearance. Key documents such as the Contract, Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin (C/O), and Import Permits (if required) must be meticulously prepared.

The consequences of minor errors

Even a small mistake in the declared information, an inconsistency between documents, or an invalid signature or seal can lead to the rejection of your entire file. The shipment can become congested at the port or border gate, incurring costs like demurrage, detention, and declaration amendment fees. This disrupts the entire supply chain, directly impacting your production and business plans.

To avoid these pitfalls, check out our detailed guide: What constitutes a complete import export document set?

Labeling and packaging – Strict standards, severe consequences

Beyond customs paperwork, overlooking regulations for product labeling or missing a specialized permit can also be a barrier, causing goods to be rejected for import or forced into costly reprocessing.

Labeling and packaging regulations

Countries have very strict regulations for the labeling and packaging of imported goods. Failure to comply with rules regarding origin, ingredients, or packaging material standards can lead to serious consequences. Expert import consulting will help you understand the specific requirements of each market.

Requirements for specialized permits

For certain specific types of goods, in addition to standard documents, specialized permits are required, such as phytosanitary/veterinary certificates, quality declarations, or certificates of conformity. The absence of these documents will prevent your goods from being cleared.

Preparing for customs procedures

In the import-export consulting process, preparing for and executing customs procedures is a critical stage. This process demands high accuracy and a deep understanding of both technical and procedural aspects, often becoming one of the biggest bottlenecks for businesses.

The complexity of electronic customs declarations

Most countries now use electronic customs declaration systems. The declaration process is complex, requiring specialized software and in-depth knowledge, which can be time-consuming and delay clearance. A minor error can cause the declaration to be rejected, requiring amendments, or even result in penalties. An export consulting service ensures your declarations are prepared accurately, facilitating a smooth clearance process.

The physical cargo inspection process

Businesses must be prepared for inspection when their shipment is classified into the “red” or “yellow” lane. This requires close coordination and thorough preparation. Any inconsistency between the documents and the actual goods can lead to the risk of temporary seizure or heavy fines.

“Hidden costs” – The silent enemy of profit

Beyond freight rates, hidden costs such as demurrage fees, fines, and especially losses from delivery delays can silently erode your profits and business opportunitie

Common types of hidden costs

“International shipping costs” are more than just sea or air freight rates. Businesses often face numerous hidden charges like demurrage (port storage), detention (container usage), and warehouse fees. Errors can also lead to customs declaration amendment fees and administrative penalties. Most importantly, shipment delays create significant opportunity costs, such as losing customers and missing key business seasons.

The direct impact on profitability

These hidden costs, though they may seem small individually, can accumulate into a significant financial burden. This is precisely why the mindset of “logistics is a cost” must evolve into “logistics is a tool for profit optimization.” An effective import-export consulting service is the key to making this change happen.

Don’t let hidden costs erode your margins. Request a transparent, no-surprise quote today!

Import export consulting at PTN Logistics

We see ourselves as more than just a shipping or customs clearance company. We are your “strategic logistics partner,” dedicated to navigating your business to success. With a deep understanding of the “hidden icebergs” mentioned earlier, we provide comprehensive import-export consulting services designed to help you overcome every obstacle and optimize your supply chain.

Guidance on regulations and legal requirements

The core of our consulting goes beyond simple execution. We conduct in-depth analysis to build a customized legal roadmap and provide expert contract advisory, ensuring your business fully protects its interests and avoids potential disputes.

In-Depth analysis and tailored roadmaps

Instead of offering generic legal information, PTN Logistics analyzes the specifics of your products, business scale, and industry. Based on this, we develop a concrete and suitable roadmap to ensure all your operations comply with current laws and regulations, helping you avoid unnecessary legal risks.

Foreign trade contract advisory

We also offer specialized consulting for foreign trade contracts. Our experts assist in drafting and reviewing the terms of international sales agreements to fully protect your rights and minimize disputes that may arise during transactions.

Consulting on import export documentation

Through a meticulous process of review and cross-checking every detail, PTN Logistics’ consulting service guarantees your document set is perfectly accurate. This completely eliminates the risk of cargo congestion and unnecessary penalty fees.

Comprehensive review & cross-checking

PTN Logistics implements an extremely rigorous review and cross-checking process for all documents related to your shipment. From the Commercial Invoice and Packing List to the Bill of Lading, C/O, and specialized permits, every document is verified for consistency and accuracy.

Minimizing error risk to nearly zero

Our goal is to ensure every document is 100% valid and accurate before being signed and submitted to the authorities. This approach virtually eliminates the risk of documentation errors, preventing goods from being held up, avoiding procedural rework, and saving you from unnecessary fines. We help you complete your import-export procedures smoothly and efficiently.

Consulting on customs processes and procedures

With our all-in-one customs declaration service, PTN Logistics acts on your behalf to handle all procedures quickly and accurately, ensuring your goods are cleared on schedule.

End-to-end customs declaration services

With a team of seasoned experts, we offer a comprehensive import consulting and customs declaration package. We will manage the entire declaration process for you—from preparing the declaration form and submitting the file to working with customs authorities for cargo inspection (if required).

Professional handling of all operations

We guarantee that all procedures are handled with speed and precision. This is a core commitment of our import-export consulting service, ensuring on-time clearance and preventing costly delays and additional charges.

Proactive support for unforeseen issues

We actively monitor shipments, forecast risks, and have response plans ready to execute the moment an issue arises, minimizing any potential damage to your business.

Vigilant monitoring and risk forecasting

The expert team at PTN Logistics doesn’t just follow procedures; we proactively monitor each of your shipments. We continuously update information and forecast potential risks that could occur during transit and clearance, such as sudden policy changes, port congestion, or force majeure events.

Fast and effective solutions

When any issue arises, our import-export consulting service immediately provides the most optimal and effective solution. PTN Logistics responds proactively, resolves any complications in a timely manner, and works to minimize the impact on your business.

Leave your details — get free procedural advice!

Why choose PTN Logistics for import export consulting needs?

Choosing the right import-export consulting partner isn’t just about finding a service provider. It’s about finding a true companion who genuinely understands and shares your business goals.

A Strategic partner mindset – More than just a consulting service

At PTN Logistics, we don’t simply work for a service fee. Our philosophy is to become an integral part of your supply chain, growing alongside you for long-term success. We don’t just solve problems; we help you see opportunities and optimize the entire process, thereby enhancing your competitive edge in the market.

Empathetic experts – experience & deep domain knowledge

Our team of specialists possesses extensive hands-on experience, particularly in import-export consulting. They combine this with a profound understanding of legal regulations, policies, and customs operations. We always put ourselves in our clients’ shoes, listening carefully to your concerns and challenges. This allows us to deliver effective solutions that are perfectly tailored to your unique business needs.

Transparent process & all-in pricing – Peace of mind on cost and timeline

We are committed to providing maximum transparency in all our operations. You will always receive detailed updates on your shipment’s progress, from the initial paperwork to final clearance and delivery.

Notably, PTN Logistics’ import-export consulting service comes with an all-inclusive pricing policy. This guarantees that there will be no surprise surcharges or hidden fees, allowing you to manage your budget and control your international shipping costs with maximum efficiency.

Learn about our team and services: Click here

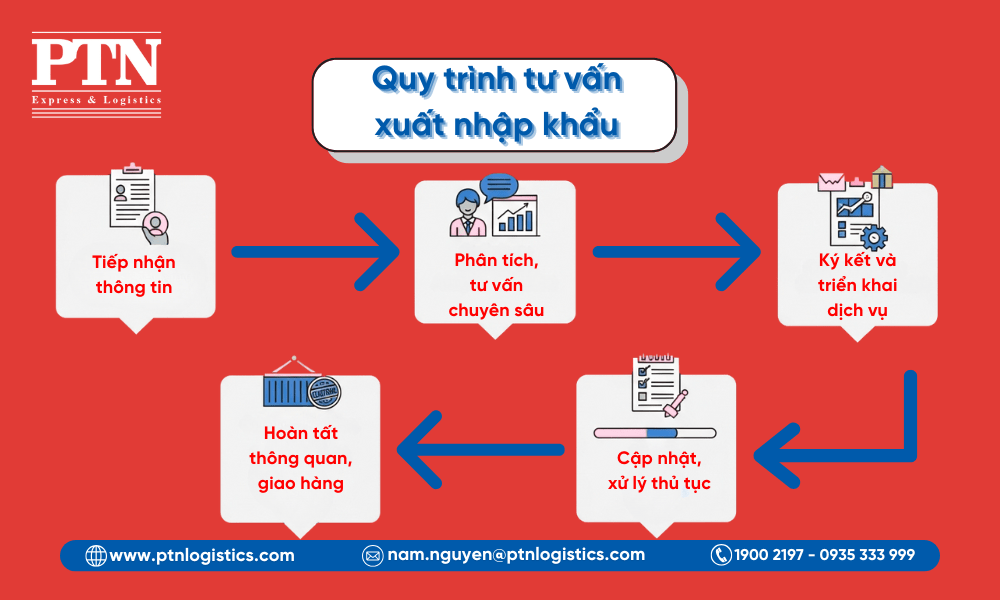

PTN Logistics’ import export consulting process

To provide the most professional, convenient, and effective service experience for our clients, PTN Logistics has developed a clear and optimized import-export consulting process:

Step 1: Receiving information & Understanding your needs

We begin by listening carefully. You simply provide us with detailed information about your goods, your import/export requirements, any challenges you are facing, and your desired outcomes. Our consulting team will record this information and conduct a preliminary analysis.

Step 2: Preliminary expert consultation, analysis, and quotation

Based on the information received, our experts will perform an in-depth analysis of your products, the relevant legal regulations, and the specific import-export procedures involved. This allows us to provide meaningful and effective recommendations. We will then present our preliminary consulting information, highlighting an optimized solution. You will receive a transparent quotation detailing the costs for customs declaration, estimated shipping, and any other potential fees.

Step 3: Signing the contract and launching the service

Once you are satisfied with our proposed solution and quotation, both parties will sign an import-export consulting contract, formalizing our commitment to the solution and costs. Immediately afterward, our team will begin implementing the agreed-upon services.

Step 4: Continuous progress updates and procedural handling

Throughout the entire process, PTN Logistics will proactively provide you with continuous updates on our progress. This commitment is a key part of our consulting service, ensuring you are always informed. All legal, customs, and shipping procedures will be handled professionally to ensure compliance and timeliness. We will also notify you immediately of any issues that arise and propose effective solutions.

Step 5: Completing clearance, delivery, and final settlement

Once the goods have successfully cleared customs and all necessary procedures are complete, PTN Logistics will coordinate the delivery to your designated location. Finally, we will complete the final settlement procedures as outlined in the contract, ensuring full financial clarity and transparency.

Fill out the form below with your shipment details to receive a quote within 5 minutes.

At PTN Logistics, we don’t just provide a service; we deliver a comprehensive solution and a “strategic logistics partner” mindset. With our team of experienced experts, deep market knowledge, and transparent work processes, we will turn the burdens of import-export into your competitive advantage.

Don’t let worries about procedures, hidden costs, or legal risks hold you back. Let PTN Logistics be your partner on this journey, helping you optimize your supply chain, save time and money, and focus on growing your business with peace of mind.

Want advice and to see how we can help your business thrive globally? Contact PTN Logistics today!

Contact Information

- Hotline: 1900 2197 – 0935 333 999

- Email: nam.nguyen@ptnlogistics.com