To confidently step out and conquer the vast international market, a growing number of Vietnamese businesses are viewing the search for a reputable import export entrustment partner as a strategic solution. With over 15 years of industry experience and a team of highly specialized professionals, PTN Logistics is proud to deliver fast, effective, and transparent import export entrustment services.

What is import export entrustment?

Import export entrustment service is the optimal solution for individuals and businesses that do not yet meet the legal, personnel, or practical experience requirements to handle import-export activities on their own. Through this service, they can easily engage in international trade in a manner that is completely legal, secure, and cost-effective.

In our role as the trusted entrusted party, PTN Logistics will represent the entrusting party to carry out the entire process related to the import and export of goods. From customs declaration, international payments, and contract negotiation to transportation, handling of specialized permits, quarantine procedures, and applying for Certificates of Origin (C/O)… Everything will be implemented transparently and in strict accordance with the laws and regulations of the respective countries.

According to statistics from the General Department of Vietnam Customs, in 2024, over 35% of import-export enterprises in our country have utilized entrustment services to minimize risks and optimize costs. This indicates that the import export entrustment model is becoming a popular trend in modern supply chain management.

Legal validity of import export entrustment services

Import export entrustment services are clearly regulated under Vietnamese law by numerous key legal documents:

- The 2005 Commercial Law (Section 3 – Articles 155 to 165): Provides comprehensive regulations on goods purchase and sale entrustment activities, and the rights and obligations of the involved parties.

- The 2017 Law on Foreign Trade Management – Article 50: Clearly stipulates the management of entrustment and receiving entrustment for the export and import of goods.

- Decree No. 08/2015/ND-CP dated January 21, 2015, as amended and supplemented by Decree No. 59/2018/ND-CP dated April 20, 2018: Specifies that the entrusted organization must meet the conditions of a customs declarant.

- Circular No. 38/2015/TT-BTC and Circular No. 39/2018/TT-BTC of the Ministry of Finance: Provide detailed guidance on customs procedures, inspection, and supervision for exported and imported goods.

- Circular No. 200/2014/TT-BTC and Circular No. 133/2016/TT-BTC: Regulate accounting methods for entrusted export and import goods.

- Circular No. 39/2014/TT-BTC: Guides the use of invoices in cases of returning entrusted goods.

- Official Letter No. 1332/TCT-NV2 from the General Department of Taxation: Provides guidance on Value Added Tax (VAT) for entrusted import-export goods.

A thorough understanding of and compliance with these regulations are mandatory for both the entrusting and the entrusted parties to ensure transparency, legality, and to avoid legal risks throughout their cooperation.

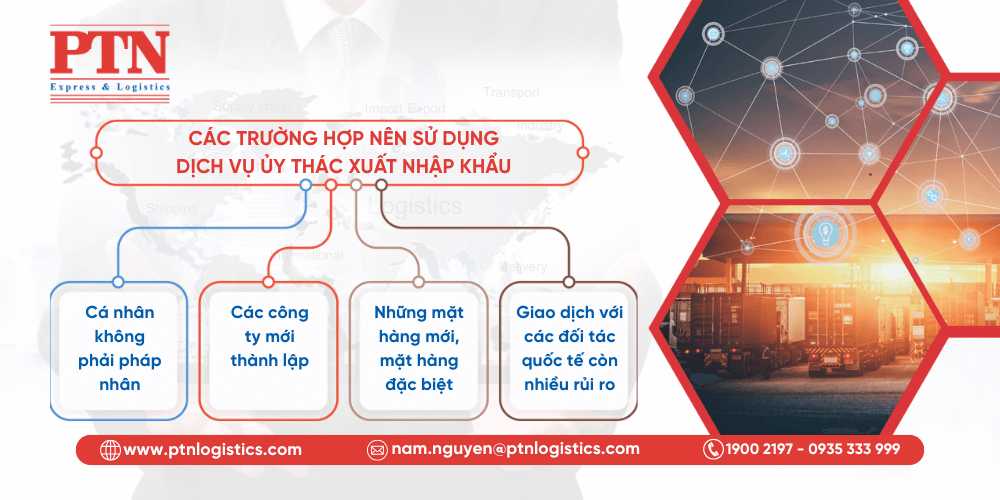

4 scenarios where you should use entrusted import export services

The rapid growth of e-commerce and the increasing need to reach international markets have presented many Vietnamese businesses with significant hurdles related to legalities, procedures, and resources.

In this context, import export entrustment services are the key to overcoming these obstacles, enabling businesses to confidently integrate into the flow of global trade. Below are the most common situations where this service is essential:

Individuals without a legal entity

For many individual traders or household businesses, there is a significant need to import goods for retail or production purposes. However, without legal entity status, they are not qualified to carry out customs procedures directly. Seeking entrustment services from a reputable logistics company is therefore mandatory to ensure goods clear customs legally and in full compliance with regulations.

Newly established companies

Startups and newly formed companies often have not yet established a dedicated import-export department or fully grasped the associated processes and procedures. During this initial phase, opting for an entrustment service helps them save significant time and costs.

This allows these new businesses to focus their resources on core activities like product development, brand building, and expanding sales channels, rather than getting bogged down by complex administrative tasks and international operations.

New or special – category goods

Certain goods, such as dietary supplements, cosmetics, medical equipment, or machinery with control circuit boards, are subject to special import-export conditions. The process of applying for permits and undergoing specialized inspections for these items is often complex and fraught with risk.

Instead of handling this cumbersome process themselves, clients can delegate the entire workflow to an import export entrustment service. They will act on your behalf to manage everything from permit applications and specialized inspections to customs declarations, ensuring your goods clear customs quickly and lawfully.

Transactions with potentially risky international partners

Most businesses are naturally cautious when dealing directly with new foreign partners due to language barriers, different legal frameworks, international payment complexities, or concerns about supplier reliability.

In these cases, an import export entrustment service acts as a trusted legal and commercial intermediary. They can verify the origin of goods, negotiate contracts, and ensure that payments and deliveries are executed as committed, effectively minimizing your risk.

Basic principles of entrusted import export

To ensure transparency, security, and full compliance, import export entrustment activities must strictly adhere to legal and operational principles.

- The entrusted party must have legal entity status and be licensed to conduct import-export services under current law.

- The entrustment must be established through a legally binding entrustment contract that clearly specifies all details, such as the type of goods, delivery terms, responsibilities for taxes and fees, and payment methods.

- Every transaction must be recorded with valid accounting documents and legal invoices.

- Goods imported or exported through the entrusted party must precisely match the agreed-upon specifications, quantity, and type.

- The entrusting party remains the legal owner of the goods, with the right to inspect, monitor progress, and request reports at every stage.

These principles not only safeguard the legal interests of both parties but also enhance professionalism and build trust in the cooperative relationship between the business and the entrusted service provider.

Import export entrustment services at PTN Logistics

With over 15 years of industry experience, PTN Logistics offers professional and leading import export entrustment services in Vietnam. This provides a comprehensive solution for individuals and businesses that are not yet equipped to handle direct import-export activities.

Don’t have an import-export tax code? Unfamiliar with customs declaration processes? Need a legal entity to manage the import or export of your goods?

Don’t worry. We provide comprehensive support, from signing contracts and processing documents to handling customs procedures and international freight. Every process is executed with transparency and in full compliance with the law, helping our clients save time and optimize costs for every shipment.

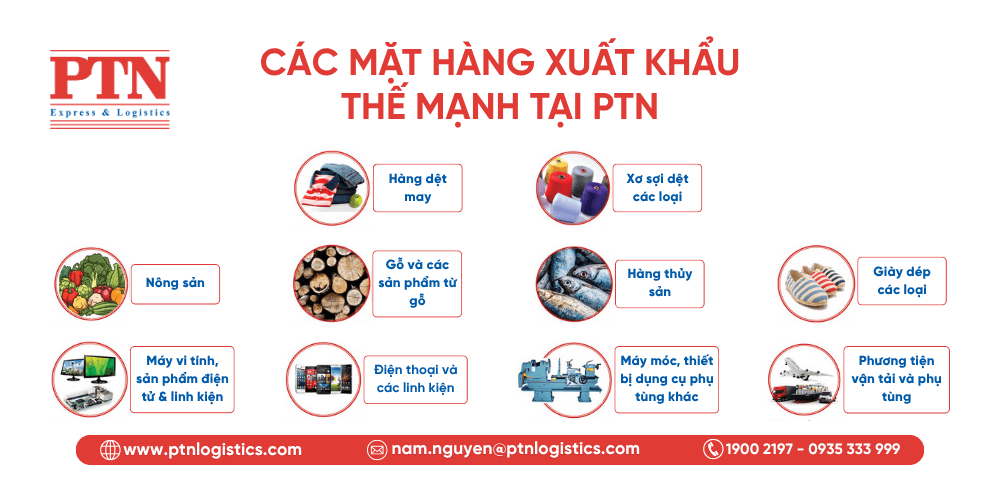

We have special expertise in providing import and export entrustment for the following categories of goods:

- Industrial supplies: Bolts, screws, pipes, machinery, etc.

- General agricultural products: Coffee, pepper, cashews, semi-processed vegetables.

- Electronics and components: ICs, circuit boards, cables, sensors, etc.

- Consumer goods: Apparel, footwear, cosmetics, home appliances.

- Goods subject to conditional export: Chemicals, precursors, minerals, agricultural-forestry-fishery products, pharmaceuticals, medical equipment, etc. These are goods regulated under Decree 69/2018/ND-CP and related guiding circulars from the Ministry of Industry and Trade, Ministry of Agriculture, and Ministry of Health.

Why choose PTN Logistics for import export entrustment services?

As a pioneer in the field of import export entrustment, PTN Logistics offers a comprehensive solution for businesses that lack the necessary legal qualifications or a dedicated internal department. Our reputation, professionalism, extensive experience, and standardized processes are the reasons why thousands of clients have chosen to partner with us.

End-to-end service – Optimized at every step

We don’t just act as the legal importer/exporter on your behalf; we manage the entire process, from verifying documents and handling customs declarations to applying for specialized permits and arranging international transportation.

The PTN team collaborates closely with reputable international carriers like Maersk, Wanhai, Evergreen, CMA CGM, and MSC, as well as a network of dedicated air freight airlines such as Emirates SkyCargo, Qatar Airways Cargo, and Vietnam Airlines Cargo.

This direct connection to major carriers gives us control over schedules, optimizes transit times, and minimizes risks in international logistics—something that businesses handling these processes on their own would find difficult to achieve completely.

Experience builds trust

With over 15 years of experience in logistics and import export entrustment, PTN has handled thousands of shipments of diverse types and scales, from consumer goods, agricultural products, and electronic components to conditional items like chemicals, medical equipment, and cosmetics.

We have practical, hands-on experience acting as the legal entity, managing specialized documentation, obtaining import-export licenses, declaring customs, and executing international shipments. Our services are especially effective for small and medium-sized enterprises (SMEs), trading companies, and newly established FDI companies in Vietnam.

The long-standing trust of our clients is clear proof of the capability, commitment, and stability that PTN Logistics has built in the market.

Legal expertise – Deep support

PTN boasts a team of specialists with in-depth knowledge of legal regulations, trade policies, and specialized inspection requirements. This allows us to provide clients with end-to-end support for requests such as import permits, Certificates of Origin (C/O), Material Safety Data Sheets (MSDS), quarantine, and quality inspections.

Personalized and flexible services for every business

We believe there is no one size fits all solution for every company – only the most suitable solution for each client. Therefore, every import export entrustment service at PTN is personalized to match the specific characteristics of the industry, shipping routes, and operational capacity of each business.

Dedicated support like part of your team

When clients use our entrustment services, they are assigned a dedicated specialist who is available 24/7, providing support from the initial document preparation stage until the goods have cleared customs and been successfully delivered.

We don’t just provide a service; we proactively consult on solutions that help our clients save time, reduce risks, and develop their import-export activities sustainably.

Exceptional value, Long – Term efficiency

PTN Logistics is committed to delivering practical value that goes beyond a simple entrustment service to become a comprehensive import-export support solution. We don’t compete on being the cheapest, but on the quality of our standardized processes, our clear legal framework, and the tangible efficiency we deliver for every entrusted shipment.

The value PTN provides is not measured in individual transactions, but in our ability to help businesses build a stable supply chain, mitigate legal risks, save time, and optimize internal resources for the long term.

-

6 reasons customers choose PTN for import export entrustment

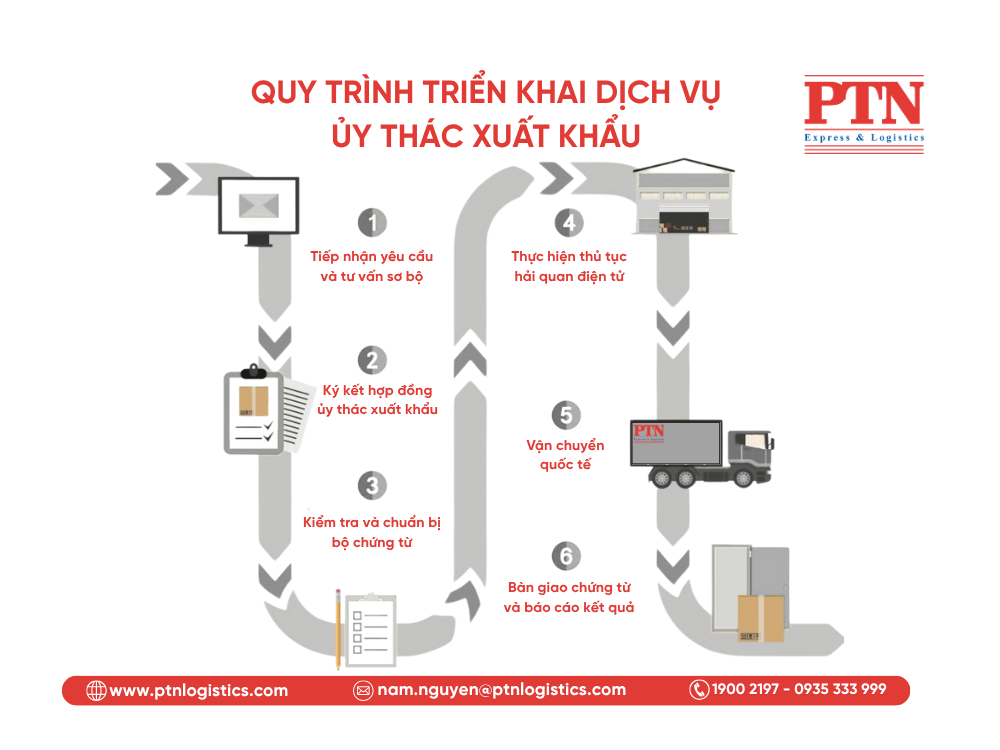

PTN’s workflow for entrusted import export services

At PTN Logistics, our import export entrustment process is systematically designed to meet the core requirements of legality, transparency, efficiency, and cost-optimization. Below are the detailed steps for each service type, helping clients clearly understand the workflow and coordinate with us seamlessly.

Our export entrustment service process

Step 1: Receiving your request and providing initial consultation

The client provides information about the goods, the destination market, and the proposed Incoterms. The PTN Logistics team will review these details and advise on the most suitable logistics plan.

Step 2: Signing the export entrustment contract

Both parties agree on the terms and conditions of cooperation and proceed to sign a formal entrustment contract.

Step 3: Verifying and preparing the document set

PTN will assist in checking and completing all necessary documents, such as the Commercial Invoice, Packing List, Certificate of Origin (C/O), MSDS, or any other specialized paperwork required.

Step 4: Executing electronic customs procedures

We act as your representative to handle the electronic customs declaration and manage the clearance process at the seaport or border gate, ensuring full compliance with all regulations.

Step 5: Arranging international transportation

We coordinate with the designated shipping line or airline to export the goods. We then provide the Air Waybill (AWB) or Bill of Lading (BL) number, update you on the schedule, and assist in tracking the entire shipping process.

Step 6: Handing over documents and reporting results

Once the goods have departed, PTN Logistics will hand over all shipping documents, report on the progress, and fulfill all remaining responsibilities as outlined in the contract.

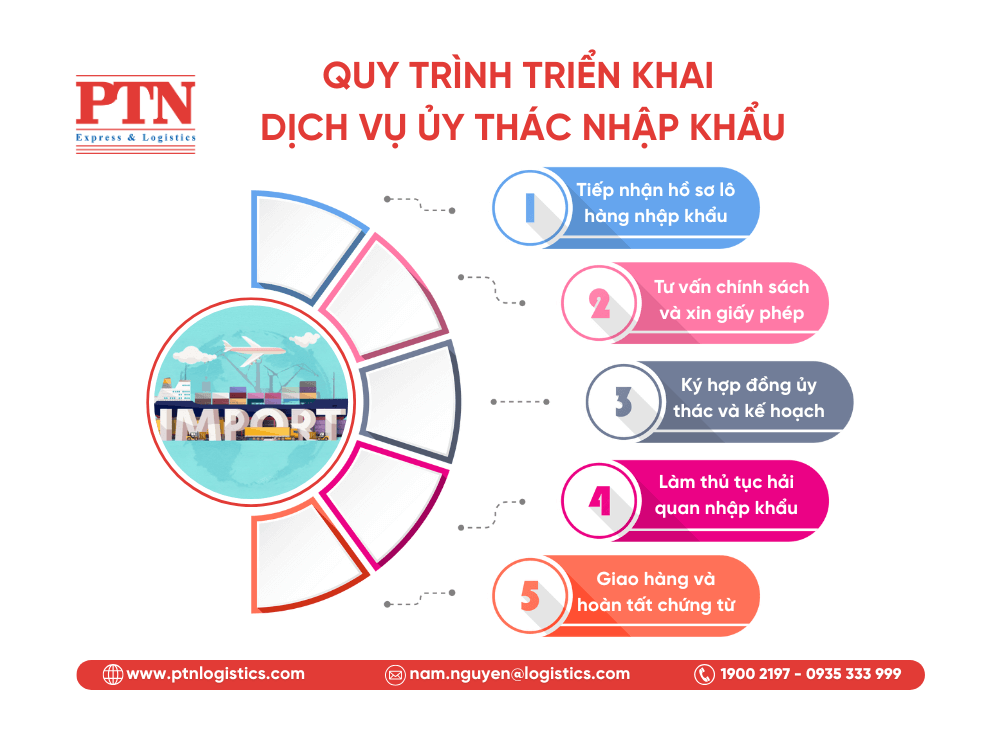

Our import entrustment service process

Step 1: Receiving the import shipment dossier

The client provides a complete set of documents, including the Proforma Invoice, Commercial Invoice, Packing List, Bill of Lading (BL) or Air Waybill (AWB), Certificate of Origin (C/O), and any other related papers.

Step 2: Advising on product policies and applying for permits (If Needed)

For goods subject to specialized management or conditional import, PTN Logistics will provide consultation and assist in applying for the appropriate permits.

Step 3: Signing the entrustment contract and finalizing the clearance plan

Both parties sign the import entrustment contract. We then develop a detailed plan for processing documents and establish a specific delivery timeline.

Step 4: Handling import customs procedures

We carry out the electronic customs declaration, coordinate with customs for physical inspection (if required), pay all applicable import taxes and fees, and complete the customs clearance process.

Step 5: Delivering goods and finalizing documentation

The goods are delivered to the client’s specified location. PTN then hands over all invoices, import documents, and a delivery receipt to serve your accounting and record-keeping needs.

Workflow for entrusted import services

Responsibilities of each party in an entrustment contract

In an import export entrustment service, clearly defining the responsibilities of each party is a cornerstone of success. This ensures the process runs smoothly, remains legally compliant, and minimizes potential risks.

Responsibilities of the entrusting party (The client)

- Provide complete information about the goods and all related documents, including the foreign trade contract (if any), delivery terms (Incoterms), and payment methods.

- Fulfill all payment obligations as specified in the entrustment contract, including import duties, VAT, shipping fees, storage/demurrage charges, inspection fees, customs declaration fees, and the service fee.

- Coordinate in a timely manner with PTN Logistics throughout the process, especially when there are changes to documentation or issues arising with the overseas partner.

Responsibilities of PTN Logistics (The entrusted party)

- Execute all legal and professional duties in strict accordance with current regulations, including customs declaration, applying for specialized permits, arranging quarantine, obtaining Certificates of Origin (C/O), and preparing shipping documents.

- Maintain strict confidentiality of all contract details, documents, and client cargo information, with an absolute commitment to not disclose them to any third party without prior written consent.

- Provide valid documents and invoices, ensuring full transparency for every cost associated with the shipment.

- Proactively provide updates and manage any arising issues, notifying the client promptly to work together towards a swift and effective resolution.

Import export entrustment is an effective solution for businesses to expand their global operations without a major investment in internal staff and legal infrastructure. Contact PTN Logistics today for a free consultation and a prompt quote from our team of leading experts.

Contact Information

- Hotline: 1900 2197 – 0935 333 999

- Email: nam.nguyen@ptnlogistics.com