Do you have loved ones abroad sending gifts home? Or are you an international shopping fan awaiting items from the US, Japan, or Europe? Today, receive goods from abroad into Vietnam is more common than ever.

However, not everyone knows the procedures and steps to ensure their favorite items arrive safely and quickly. PTN Logistics is ready to be your companion, helping you solve every issue along the way.

Not sure where to start? PTN can guide you step by step!

Why you need a professional receive goods from abroad service

Receiving goods from abroad is more than just placing an order and waiting. The process is filled with potential risks, such as lost packages, items getting stuck at customs, or difficulties with import procedures and language barriers. For those without experience, handling everything on your own can easily lead to mistakes and be very time-consuming.

Shopping from abroad: What’s needed besides “Placing the order”?

When you buy an item from the US, Japan, or Europe, it involves more than just the simple act of “ordering.” In reality, the process of receiving goods from overseas in Vietnam comes with many potential risks and challenges:

- Lost or stuck at customs: Have you ever experienced the anxiety of waiting, only to find your order has vanished without a trace or is being held at customs for some reason? Many shipments are lost or get stuck at the border due to missing paperwork or a lack of understanding of customs clearance regulations, especially when the recipient tries to handle the procedures without prior experience.

- Language barriers and complex procedures: Communicating with international partners, deciphering complicated customs regulations in English or other native languages, and calculating import duties and international shipping fees on your own can be daunting.

- Lack of import experience: This is especially true for individual customers or small businesses importing for the first time. Managing the entire process from start to finish is a significant burden. You need a detailed guide when receiving goods from abroad for the first time.

Unsure which documents you need? Send a quick support request.

PTN Logistics – The bridge between you and the world

To eliminate all barriers when receiving goods from abroad, PTN Logistics offers a comprehensive international receiving solution. We provide peace of mind, making your dream of “bringing the world to your doorstep” a reality:

- Global agent network: With a presence in Japan, the UK, the US, Germany, Malaysia, and many other countries, we ensure that receiving goods at the origin warehouse is a smooth and secure process. You no longer have to worry about the sender’s struggle to find a reliable address to drop off the shipment.

- Simplified process, A-to-Z support: PTN is not just a shipping company; we are your dedicated partner. We guide you every step of the way, from initial information intake and paperwork processing to import customs clearance and final door-to-door delivery.

- Ensuring fast and safe delivery: We commit to full transparency on all related costs, giving you complete control over your finances and delivery timeline. We guarantee your goods will arrive safely, intact, and exactly as you expect.

Learn more about full-service customs brokerage. Click here!

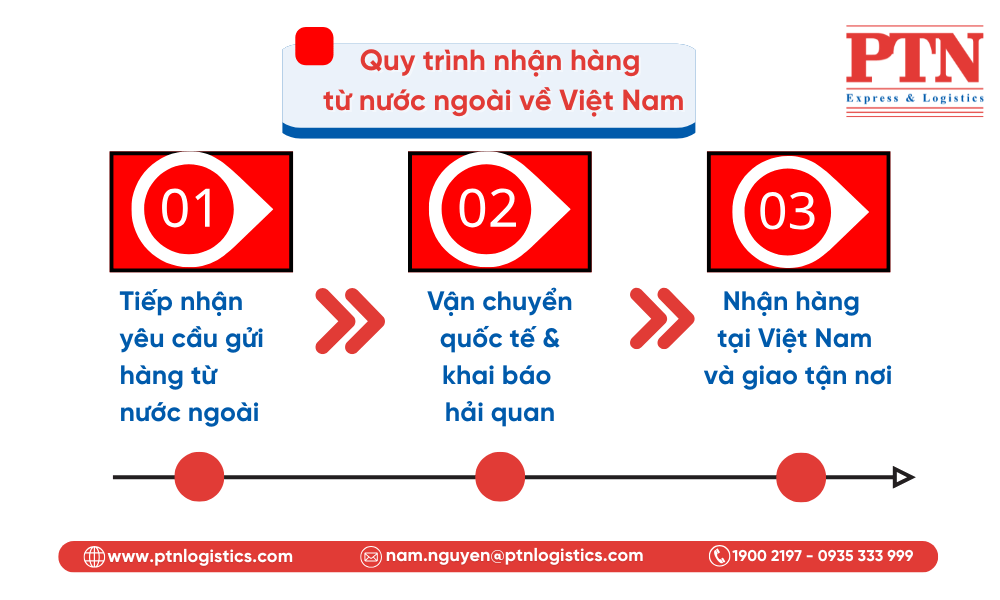

PTN Logistics process for receive goods from abroad into Vietnam

With PTN Logistics, receiving goods from abroad is made easy in just 3 simple steps:

Step 1: Receiving your international shipment request

All you need to do is provide your order information or request an assisted purchase. Our team will proactively contact our international partners to receive the goods at the origin warehouse. We handle all the initial procedures for you, saving you time and effort.

Step 2: International transport & customs declaration

Once your goods are received, we will advise on and select the optimal shipping method for your shipment – air freight (for urgent items) or sea freight (for bulky or non-urgent goods).

Crucially, PTN will handle the customs declaration on your behalf, completing all procedures for receiving international goods quickly and accurately.

With our extensive experience, we have a deep understanding of HS code regulations, ensuring your goods clear customs smoothly and minimizing any risk of delays.

Step 3: Arrival and door-to-door delivery in Vietnam

When the goods arrive in Vietnam, we will inspect, sort, and assist you with completing any applicable tax obligations.

Afterward, the shipment will be transported and delivered directly to the recipient in any province across the country. All you need to do is wait and receive your items without the hassle of travel or worrying about the final stage of delivery.

See the complete logistics checklist so you never miss a step!

PTN Logistics – A complete solution for receive goods from abroad

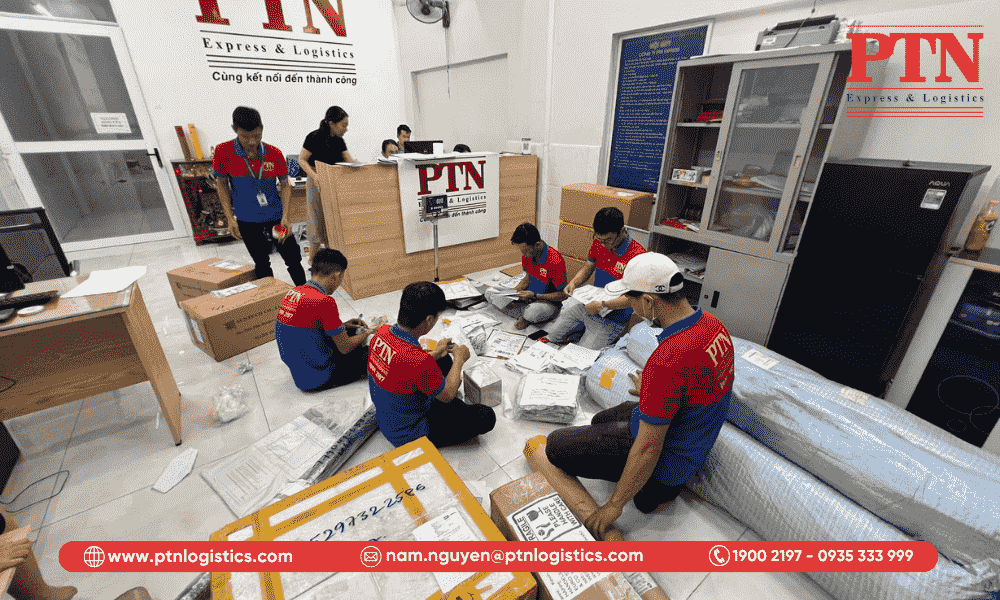

We understand that receiving goods from abroad can be complex and fraught with risks. That’s why we don’t just offer a shipping service; we provide a comprehensive solution built on strong in-house capabilities and a deep understanding of the industry. This approach gives you absolute peace of mind when entrusting us with your important items.

Our outstanding competitive advantages

We take pride in the core values that set us apart in the market:

Over 15 years of specialized international logistics experience

With nearly two decades in the international logistics sector, PTN has accumulated a vast wealth of knowledge. We have an in-depth understanding of customs regulations in key markets such as the US, Japan, South Korea, China, and the European Union (EU).

This allows our team to anticipate and swiftly resolve any issues that may arise, ensuring your goods achieve the smoothest possible import customs clearance.

A multi-channel and multinational logistics network

We have built a robust network that extends far beyond national borders. With bonded warehouses, representative offices, and a system of strategic partners in many key countries, we have created a seamless and flexible supply chain. This guarantees that receiving and transporting goods from anywhere in the world is handled efficiently.

Modern waybill management & tracking

We apply advanced technology to our management systems so you can always stay informed about your shipment’s status. You can easily track your order online through our modern tracking system, and automated notifications about its status, transit time, and customs clearance will be sent to you.

Furthermore, our tools also support HS code lookups and provide cost estimates for receiving international goods, giving you full control over information and finances.

Flexible, optimized workflows for every commodity

We don’t apply a one-size-fits-all process. Every shipment is unique, whether it’s a personal gift, commercial goods, product samples, or fragile items, and each requires a different approach.

We optimize the process from packaging and declaration to transportation to ensure maximum efficiency and minimize risk for each specific type of cargo.

Professional clearance team versed in international law

This is PTN’s most valuable asset. Our team of customs specialists is not only highly skilled in their field but also constantly updated on changes in international law.

They are capable of handling the most challenging shipments, from missing paperwork and detained goods requiring urgent supplements to complex cases that need detailed explanations for customs authorities.

Why should you choose PTN Logistics?

Choosing PTN Logistics isn’t just selecting a service; it’s choosing a dedicated partner who delivers real value and resolves all your concerns:

Not familiar with paperwork? PTN handles it end-to-end

We know that the procedures for receiving goods from abroad can be complex, especially documents like invoices, packing lists, and customs declarations.

PTN Logistics provides a full-package support service, from proper packaging and professional transport to expert customs declaration and final door-to-door delivery. You just provide the basic information, and our company will handle the rest.

Clear, transparent quotes with no hidden fees

A customer’s biggest fear is unexpected hidden charges. We are committed to providing a detailed and clear price breakdown from the very beginning. All costs related to international shipping fees, import duties, and surcharges (if any) are advised and agreed upon before you ship. This gives you complete financial control without worrying about going over budget.

Tailored solutions for every customer group

Whether you are an individual receiving a meaningful gift, an online shop owner importing small quantities, or a small business seeking a partner for commercial imports, PTN has a distinct and optimized service package for you. We always listen to your needs to provide the most suitable solution.

On-time delivery with dedicated support

Time is money. PTN Logistics is committed to delivering your goods by the agreed-upon time. Our team closely monitors every order, from the moment it leaves the origin warehouse until it reaches your hands. Any issues that arise are handled promptly and professionally.

Dedicated 1 – on – 1 Support – Every client matters, regardless of shipment size

We believe every customer, no matter the size of their order, deserves maximum attention. Our consulting team is always ready to provide 1-on-1 support via Zalo, phone, or email, even after 5 PM or on weekends.

Whenever you have questions about customs procedures, HS codes, or your order’s status, we are here to listen and provide dedicated assistance.

Need step-by-step guidance for your first time receive goods from abroad? Message us—1:1 support is free!

Address tips to receive shipments from overseas accurately

Writing the correct address is a key factor in ensuring your order arrives safely.

Tips for writing a standard international address

📝 Full and accurate recipient name and phone number: This is the most critical information for the carrier to contact you during delivery.

📝 Use a clear address structure: Always write the full address: House Number – Street Name – Ward/Commune – District – City/Province – Vietnam’s Postal Code. For example: “123 Le Loi Street, Ben Thanh Ward, District 1, Ho Chi Minh City, 700000”.

📝 Avoid abbreviations and incorrect ZIP codes: The ZIP/Postal Code is crucial for sorting and routing mail and goods. An incorrect code can cause your shipment to be misdirected or delayed.

How PTN helps check & confirm your address

To keep everything smooth, we’ll help verify your address in our system and guide you through correct formatting—especially for orders from marketplaces like Amazon, eBay, and Taobao, which may have unique address requirements.

Unsure about documentation? Send a quick request for free advice!

Fees and taxes for international shipments: What to prepare for?

Understanding the various fees and taxes for receiving goods from abroad will help you manage your finances and avoid unexpected surprises.

Common fees when receiving international shipments

When receiving goods from abroad, you will typically encounter the following costs:

- International shipping fees (Air/Sea Freight): This is the main cost for transporting goods from abroad to Vietnam. It can be by air (fast, for high-value or lightweight items) or by sea (economical, for bulky or large-quantity goods).

- Service and storage fees (if applicable): These apply if a shipment is held in a warehouse beyond the specified time limit or requires special services like repackaging or inventory counting.

- Domestic fees (Last-Mile Delivery): This is the cost of transporting the goods from the port/airport to your final delivery address in Vietnam.

How import duty & VAT are calculated in Vietnam

Import duty and value-added tax (VAT) are the two main taxes you need to be aware of when receiving goods from abroad:

- Based on declared value + HS code: The tax amount depends on the value of the goods declared on the customs form and the product’s HS Code. Each type of product has a unique HS Code and a different tax rate.

- Types of taxes: These include import duty, VAT, special consumption tax, anti-dumping duty, and other taxes depending on the product category.

PTN Logistics offers a fast and transparent tax calculation tool that is always updated for each product type. Simply provide the product information, and we will help you accurately estimate all receiving fees and taxes from the start. This allows you to have full control over your costs.

Need a cost estimate? Fill the form to get a detailed quote now!

Important considerations when receiving goods from abroad in Vietnam

To ensure a smooth process for receiving international goods, you need to be aware of several key issues.

Items requiring permits or subject to restrictions

Not all types of goods can be imported easily. Certain items such as cosmetics, pharmaceuticals, special electronic devices, or sensitive goods often require import permits and quality inspections.

Additionally, they must comply with specific regulations from the Ministry of Health and the Ministry of Industry and Trade. Furthermore, any goods prohibited by the Ministry of Industry and Trade will not be allowed entry under any circumstances.

Avoiding the risks of not using a professional service

Self-declaring customs can easily lead to errors and penalties: If you lack in-depth knowledge of laws and regulations, handling your own customs declaration can lead to costly mistakes. A minor error on the customs form could cause your shipment to be detained, incurring daily storage fees, or even result in financial penalties.

Misunderstanding the law can lead to detained or destroyed goods: Without a clear understanding of the procedures for receiving international shipments, your goods could be held indefinitely at customs. They could even be destroyed if the required documents are not submitted within the deadline. This not only causes financial loss but also wastes your time and effort.

This is why you should trust a professional partner like PTN Logistics. We will provide free consultation on customs declaration and help prepare all necessary documents, ensuring all procedures are compliant, swift, and legal.

Free customs-declaration guidance — Register now!

Receive goods from abroad is no longer a worry with PTN Logistics by your side. We provide optimal solutions that save you time, money, and effort – whether you’re an individual receiving a small gift or a business importing a large shipment. Expect professional, transparent, and effective service.

Are you ready to turn complex international transactions into a simple, stress-free experience? Contact PTN Logistics today for a professional and completely free consultation!

Contact Information

- Hotline: 1900 2197 – 0935 333 999

- Email: nam.nguyen@ptnlogistics.com